Despite the financial uncertainty caused by the pandemic, the housing market for the San Francisco Bay Area is as strong as ever.

According to the California Association of Realtors (C.A.R.) December 2020 resale housing report—median price for single family homes:

- San Mateo County – up 15.3% to $1.7 million

- Santa Clara County – up 12.2% to $1.4 million

- Contra Costa County – up 14.7% to $763,000

- Alameda County – up 20.2% to $1.1 million

Why are home prices trending upwards?

Most notably it is the combination of the following economic factors:

- Low interest rates

- Low for-sale inventory

This, according to Chief Economist Jordan Levine, is because “the imbalance between supply and demand continues to fuel home price gains as would-be home sellers remain reluctant to list their homes during the pandemic.” It puts a squeeze on available inventory, which drives up the price of homes listed—yet buyers fears are assuaged because of the favorable interest rates.

Ultimately, Covid-19 changed the motivations of all parties in the market. Sellers, weary about opening their homes to the public are holding off and bringing down supply. And buyers wanting to take advantage of low rates are bringing up demand.

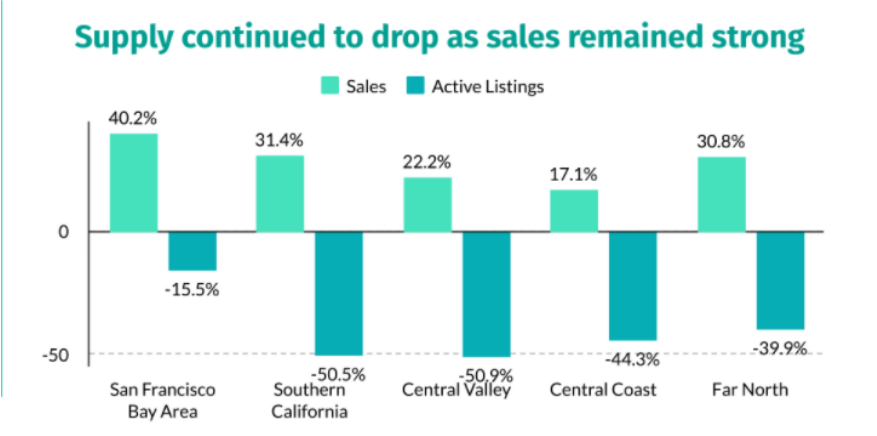

Despite the rising prices, sales are up by 40.2%, while active listings are down.

This is not unique to the Bay Area.

The growth mirrors prices spiking across the country as “the national home price grew by 9.2% since 2019, while prices in California jumped by 7% in the last 12 months.” This reported in the San Mateo Daily Journal.

Low mortgage rates aren’t the only reason renters are inclined to buy.

It seems the pandemic has created a shift in what people value in a living space. “Buyers are less concerned about daily commutes and more focused on bigger homes,” says Levine in a Mercury News article.

This is very much apparent with millennials. Many who now work from home and are no longer plagued with commutes have headed to the suburbs from big cities like San Jose and San Francisco.

This holds true on a national level as well. According to new research from investment management firm, Cowen and Company, “there’s been a noticeable migration among people ages 25 to 34 from urban areas to suburban ones.”

Of the 27,000 Millennials surveyed nationally in 2020:

- Those living in suburbs up 4% from 2019

- Those living in cities dropped 3% from 2019

“This suburbanization trend has been slowly occurring since 2017, and we expect it to accelerate with the COVID-19 disruption,” Cowen analyst John Kernan wrote. “These results are also corroborated by a shift in home ownership.”

Will the market remain strong into 2021?

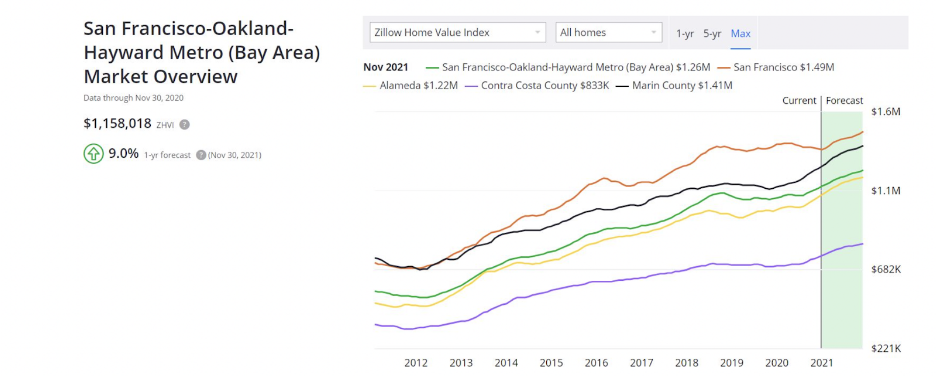

The short answer is yes. “Economists forecast an even stronger 2021 with more sales, higher prices and greater demand.” As reported in the Mercury News.

Image courtesy of Zillow.com

As vaccines are slow to roll out, and social distancing mandates still in effect, we can expect housing prices to continue its upward trajectory.

More Helpful Articles

Glow Into the New Year With the Exploratorium

Holiday lights may be coming to an end, but you can still light up the new year with Glow at the Exploratorium! Running through January 25th, Glow is a series of eight immersive light art exhibits. Each exhibit has been designed by a different artist and provides a...

Gingerbread Cookies—Tips and Recipe

Gingerbread cookies are a holiday staple, but many of us find the process of making them tedious and frustrating. Don’t give up on these holiday treats! Below are some tips to take the headaches out of making gingerbread cookies, as well as a favorite recipe. Bon...

Holiday Outdoor Ice Skating

Outdoor ice skating is a great way to take a break from the holiday hustle. These outdoor ice rinks make for a fun outing for kids and adults. Union Square Ice RinkNovember 5, 2025, through January 19, 2026Daily 10:00am-11:00pm333 Post St.San Francisco, CAOutdoor...

Recent Comments